In trading, being ahead of the market is everything, and perhaps one of the most helpful instruments available to traders is the Commitment of Traders report. Every week, the report provides a thorough analysis of large market participants’ positions, covering commercial hedgers, institutional speculators, and small retail traders. By examining the numbers, the traders can get critical information on what the prevailing mood of the market is and what kind of price action is likely.

Very few traders consider the importance of CoT reports to their trading. Instead of another set of figures, the CoT reports give insight into the minds of the market movers as a group. Knowing the positions of various groups can establish the underlying dynamics of market trends, warn of impending reversals, or validate continuations. In this article, we will talk about what CoT reports are, how to read and understand them, and how you can strategically use them in your trading strategy to get a better insight into market sentiment and identify opportunities.

Think of being able to track the moves of large commercial hedgers hedging against price movement with futures or speculators betting on the next market big move. With CoT reports, you can. CoT reports provide much-needed transparency, allowing traders to view the positioning of market participants and how their activity can influence future direction of price. We’ll walk you through the highlights of the CoT report, and show you how to apply this valuable information to make your own trading decisions with greater confidence.

What are CoT reports?

The CoT is a weekly publication issued by the US Commodity Futures Trading Commission (CFTC) that indicates the positions of various market groups in the futures and options marketplace. They include commercial hedgers, non-commercial speculators, and small traders, and most often a snapshot of who’s short, who’s long, and how much total volume is taken.

The CoT is used to identify the overall mood of the market, no matter the participants in the market are long or short, and discover potential trend continuations or reversals. The CoT will be a component of the entire fundamental analysis employed by the traders, complemented by technical indicators, to discover entries or exits.

When are CoT reports published?

CoT reports are released Fridays at 3:30 PM ET, showing market participant positions on the preceding Tuesday. While disclosing trend data in the marketplace, it should be noted that the data is little out of date and thus the report is not current sentiment but rather an indication of what occurred in the past.

The timing of release enables one to gauge medium-term trends, since the data will show the position of the traders for the last few days. This makes CoT useful for analyzing the larger picture and longer-term market trends, but not so much for short-term or intraday prediction.

How to analyze CoT reports

Understandings of reading and interpreting the CoT reports are required in order to properly apply them. The report categorizes the traders into three broad categories based on their roles in the market:

- Commercials (Hedgers): These are large business producers or businesses (e.g., farmers, oil businesses) who employ futures to hedge future price movement in their operation. They tend to have long positions reflecting their view regarding future movement of price.

- Non-Commercials (Speculators): Institutions, hedge funds, and large traders who are looking to make money from the direction of markets. Their positions are a reflection of prevailing market sentiment and will tend to exhibit momentum or trend-following.

- Non-reportable (Small traders): Retail traders with positions usually small enough not to have any significant effect on the market. They will trend-follow but are less significant when it comes to setting direction of the market.

CoT reports quantify the positions of each category in long (buy), short (sell), and net position (long minus short) terms. The information usually breaks down into tables, of which key indicators are:

- Long positions: Price-increasing speculating traders.

- Short positions: Price-decreasing speculating traders.

- Net position: Long minus short, representing the overall market sentiment.

- Open interest: Number of contracts in the market that are outstanding.

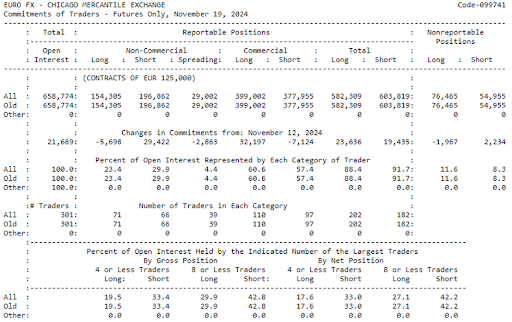

The following is a sample CoT report of euro FX futures indicating the positions of different market participants and their long and short commitments:

Example of CoT report analysis

Let’s consider the euro FX futures (equivalent to EUR/USD) from the CoT report. Here’s a breakdown of the positions for each group of traders:

| Trader Group | Change in Long Positions | Change in Short Positions | Net Position | Conclusion |

| Non-Commercials (Speculators) | -5,698 contracts | +29,422 contracts | -27,567 contracts | Bearish sentiment — a large number of short positions. |

| Commercials (Hedgers) | +32,197 contracts | -7,124 contracts | +25,073 contracts | Bullish sentiment — hedgers are accumulating long positions, expecting price rise. |

| Non-Reportable (Small Traders) | -1,967 contracts | +2,234 contracts | +267 contracts | Small traders are bullish, but their positions are too small to affect market sentiment. |

What this tells us:

- Speculators (Non-commercials) are bearish on the euro, with a large buildup of short positions, suggesting they expect the price to decline.

- Hedgers (Commercials), however, are bullish, as they accumulate long positions, indicating they expect the euro to rise.

- Small traders have a slight bullish bias, but their positions are minimal, meaning their impact on the market is insignificant.

This divergence between speculators and hedgers can signal a potential trend reversal. If speculators continue to build short positions while hedgers remain long, the euro could be nearing a bottom, and a potential rally might be imminent.

Let’s consider the euro FX futures (which correspond to the EUR/USD pair). The CoT report might show the following data for speculators (non-commercials):

- Change in long positions: -5,698 contracts

- Change in short positions: +29,422 contracts

- Net position: -27,567 contracts

Conclusion: Speculators have a bearish sentiment toward the euro, as they hold more short positions than long.

On the other hand, hedgers (commercials) might show:

- Change in long positions: +32,197 contracts

- Change in short positions: -7,124 contracts

- Net position: +25,073 contracts

Conclusion: Hedgers are taking more long positions, indicating that they expect the euro’s price to rise.

Finally, small traders (non-reportable) might show:

- Change in long positions: -1,967 contracts

- Change in short positions: +2,234 contracts

- Net position: +267 contracts

Conclusion: The positions of small traders are not significant enough to affect market sentiment in this case.

What does this mean?

Recalling this example, we can ascertain that speculators (non-commercials) are short the euro and commercials are long euro and hedging for future price appreciation. This difference between hedgers and speculators is a sign of a possible reversal in the direction of the trend if speculators continue to add shorts and hedgers accumulate longs.

How to use CoT reports in trading

Seek divergences: When hedgers are long and speculators are short heavily, then the market is said to be overheated and a turn could be at hand. Or when hedgers are long and speculators short, then the market might soon rally.

Market sentiment: A sharp change in the net position of a crowd can be a sign of potential future reversals of trend. If, for example, speculators suddenly become bullish about a currency, this could signify growing eagerness to buy the currency in the market.

Use in combination with technical analysis: Don’t rely on the CoT report exclusively. Use it in combination with technical indicators such as support/resistance lines, moving averages, and momentum oscillators to confirm entry and exit points.

Accessing CoT data

To download the official CoT reports, visit the CFTC website:

👉 https://www.cftc.gov/MarketReports/CommitmentsofTraders/index.htm

There, you can download the latest reports in different formats such as PDF, TXT, and CSV.

Steps to find relevant CoT data

1) Select the report type:

- Legacy reports: Provides old-style CoT data with positions classified into Commercials, Non-commercials, and Non-reportable.

- Disaggregated reports: More granular categories for more detailed analysis.

- Financial reports: For monetary markets such as currencies and bonds.

2) Select your market:

Scan through the list of the listed assets such as gold, oil, or currencies to make selection of the respective CoT data.

3) Download and analyze:

Reports are filed for manual review in PDF or TXT format or for auto-processing in CSV format.

Maximizing CoT insights for smarter trading

The CoT report is an invaluable tool that gives essential data on the market positions and sentiment, enabling traders to see what the large market participants are doing. Used properly, the CoT can control trend reversals or continuation. But it’s best employed when coupled with other types of analysis. This is how to maximize the CoT report:

- Observe major market participants: Observe commercial hedgers’, institutional speculators’, and small traders’ positions to ascertain market sentiment.

- Look for divergences: Convergence or divergence of hedgers and speculators can be utilized to predict trend changes or oversold/oversold situations.

- Combine with technical analysis: Combine CoT with chart patterns, indicators, and fundamentals in an attempt to confirm the soundness of your trades.

- Use with risk management: Maintain a disciplined risk management strategy to avoid overexposure, especially during times of high volatility.

The CoT is a good indicator, but not to be used in isolation. Use it to confirm market expectations and align trades with the overall market sentiment for improved and more confident-informed decisions.