Forex trading means fast and accurate order execution. But what really happens at the moment when a trader clicks the “Buy” or “Sell” button in the MetaTrader terminal? Let us consider the whole order path – from sending to execution.

1. Sending an order from the trading terminal

When a trader places an order (pending or market) via MetaTrader, the terminal sends a request to the broker’s server. At this point, the terminal checks the order’s correctness: is there enough money in the account and does the request correspond to the established restrictions and trading parameters. If the order is incorrect in any of the parameters, it will not go further, and the broker’s server will refuse to execute.

2. Sending an order to the broker’s data center

After checking in real time, the order is sent to the broker’s server. To reduce latency and speed up execution, brokers use data centers in strategically important locations around the world (e.g. New York, London, Singapore). MetaTrader uses a network of distributed servers to send orders to the nearest data center, which reduces latency.

What to do with an order if the data center fails?

In the event of a failure or disconnection of the data center through which the order is transmitted, the following may occur:

- Redirection to a backup server. MetaTrader has a distributed server system, and if one data center is unavailable, the order is automatically redirected to another.

- Delay in execution. If the backup servers are overloaded, there may be a temporary delay in order execution.

- Cancellation of the order. In the event of an emergency, if the request cannot be transmitted, the order may be cancelled or returned to the terminal with an error message.

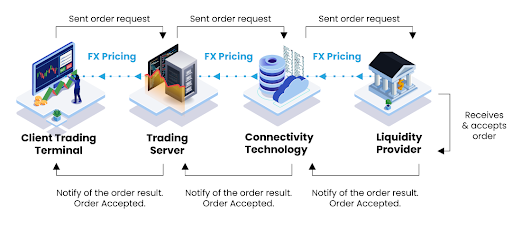

3. Transmission of the order to liquidity providers

Depending on the broker’s execution model (A-Book or B-Book), the order may:

- Remain with the broker (in the case of the B-Book model, the accepted market maker scheme);

- Can be redirected to the interbank market (if the broker uses the A-Book model and redirects trades to liquidity

providers). If an order is routed to the interbank market, it is routed to the ECN (Electronic Communication Network) or liquidity providers, who execute it at the best available price.

When might a liquidity provider reject an order?

A liquidity provider may reject an order for several reasons:

- High volatility. If the market moves too quickly, the price may change before execution.

- Lack of liquidity. If there are not enough orders at the desired price, the order will not be executed.

- Trading restrictions. Some liquidity providers limit the execution of certain types of orders or securities.

- Technical failure. Communication problems, latency, or technical failures may cause an order to be rejected.

After a rejection, an order may be re-quoted (with a new price if execution is immediate) or rejected entirely.

4. Order execution

When an order reaches the execution endpoint (broker or liquidity provider), it is executed at the current market price. If Market Execution is used, the trader receives the next available price. If Instant Execution is used, the broker executes the order at the quoted price or rejects it if the quote changes.

5. Confirmation of execution and feedback

Then the news about the executed transaction is distributed back along the chain: through the data center, back through the broker’s trading server to the liquidity provider (or broker), and then back to the trader’s terminal. The operation generally takes milliseconds, although its speed and accuracy depend on the quality of the broker’s infrastructure. It should also be noted that with high volatility, with the broker’s market execution type, the order may be executed with slippage. This is due to the fact that with high volatility, the price moves faster than the order goes through the entire chain of checks and is executed. Another abnormal case is when a trader receives a stop loss (a pending market order) on a news release, but during the execution on the server, the price sharply moves in the trader’s direction, and the new current price returns to the terminal with a profit.

MetaTrader order processing sequence

To illustrate the entire process, the following sequence of steps can be established:

- The broker server checks the order for compliance with trading conditions.

- Broker data center — routes the order to the nearest data center to minimize latency.

- Liquidity provider / ECN (in case of A-Book) or processing inside the broker (in case of B-Book).

- Order execution — at the market price on the broker side or on the liquidity provider side.

- Data feedback — information about the completed transaction is returned along the same chain.

The final word

The order path in MetaTrader is a complex and fast process consisting of a number of stages: verification, sending to the data center, potential transmission to the interbank market and final execution. The closer the broker’s server is to the main data centers, the faster the orders are executed, which is especially important for scalpers and algo traders. The success of trading depends on choosing a good broker with high-quality infrastructure.